Hello Guy, if you are looking for the best payment apps in India, you are at the right place because here we will review the top-rated payment app that iMobile Pay App, and we will cover all the topics related to the iMobile pay app.

If you are searching for a secure mobile banking application, then the iMobile Pay application can be the best choice for you. Well, this application is officially launched by ICICI Bank, so the application is fully safe and secure.

So, if you want to use this application and you don’t know about it, then firstly, you should know about this ICICI Money Transfer App. Read this article at the end to know all about What is the iMobile Pay App and How to use the Mobile Pay App? Also, we will share the highlighted features, benefits, and disadvantages of this Payment app.

What is the iMobile Pay App?

iMobile Pay App by ICICI Bank is designed to give you an experience of a banking app unlike any other. The features are built with the goal of making your transactions easier, faster, and more secure.

Also, this application is not only limited to ICICI Bank customers but, if you have an account in any other bank and you want to use this application, then, you can easily add any bank account to this application.

It provides a secure and easy way to make payments, send or request money, and transfer funds from directly your bank account. iMobile Pay lets you pay at contactless terminals, UPI-enabled merchants, e-commerce websites, and any other merchant accepting card payments.

You can do easy UPI payments through this app, and it is one of the best UPI payment apps in India.

How To Use iMobile Pay App?

iMobile Pay is a fast, simple, and secure way to pay for purchases made at any of our stores. No matter where you are in the world, simply download the iMobile Pay application to your smartphone, scan the barcode, or type in the amount you wish to pay, and complete your transaction.

You can use it with any payment card, including MasterCard, Visa Card, and also with UPI.

If you want to open your account at ICICI Bank, you can also do it with this application by ICICI bank. You just have to login into the app first, then select the option to open a Bank account, and then you have to fill the form and submit the required documentation. All Done!

Using the iMobile Pay app with an ICICI Bank account and with any Bank Account is very simple and secure.

How to Add Bank Account in the iMobile Pay App?

- First, you need to download the iMobile Pay App from the google play store.

- Then open the App and “Allow some permissions“.

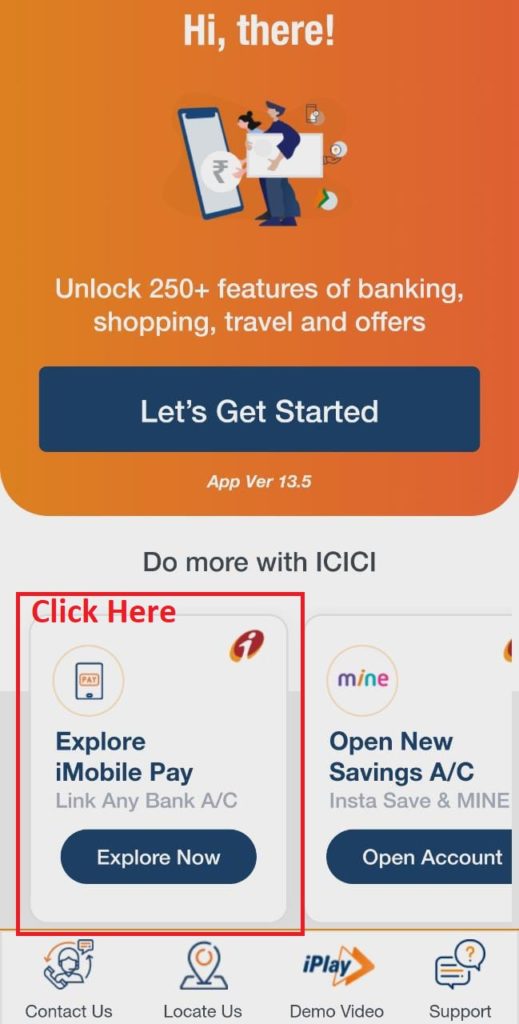

- Now, Find the “Explore iMobile Pay” option and Click on th “Explore Now” Button.

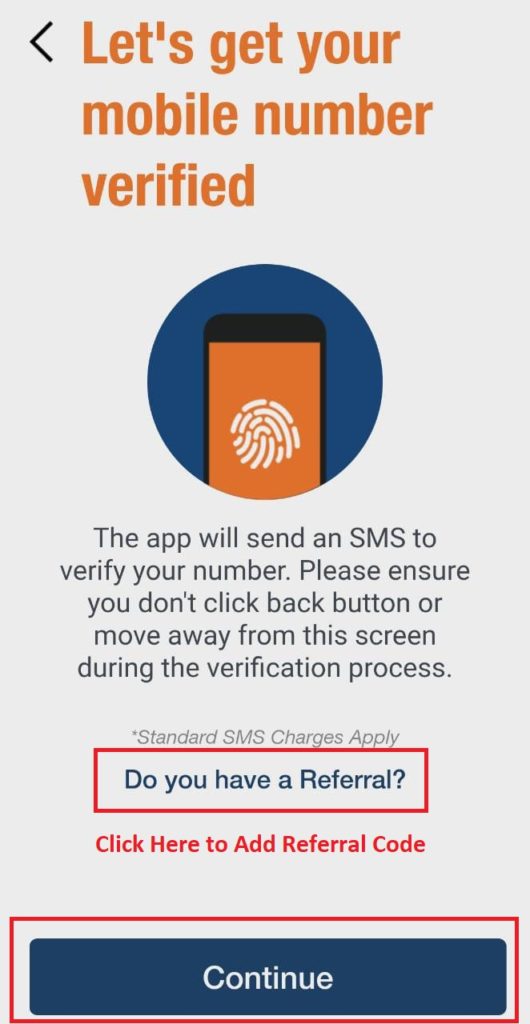

- Next, you need to verify your phone number, click on the Continue Button. (If you have a referral code, then Click on the “Do you have a Referral” and Submit the referral code.)

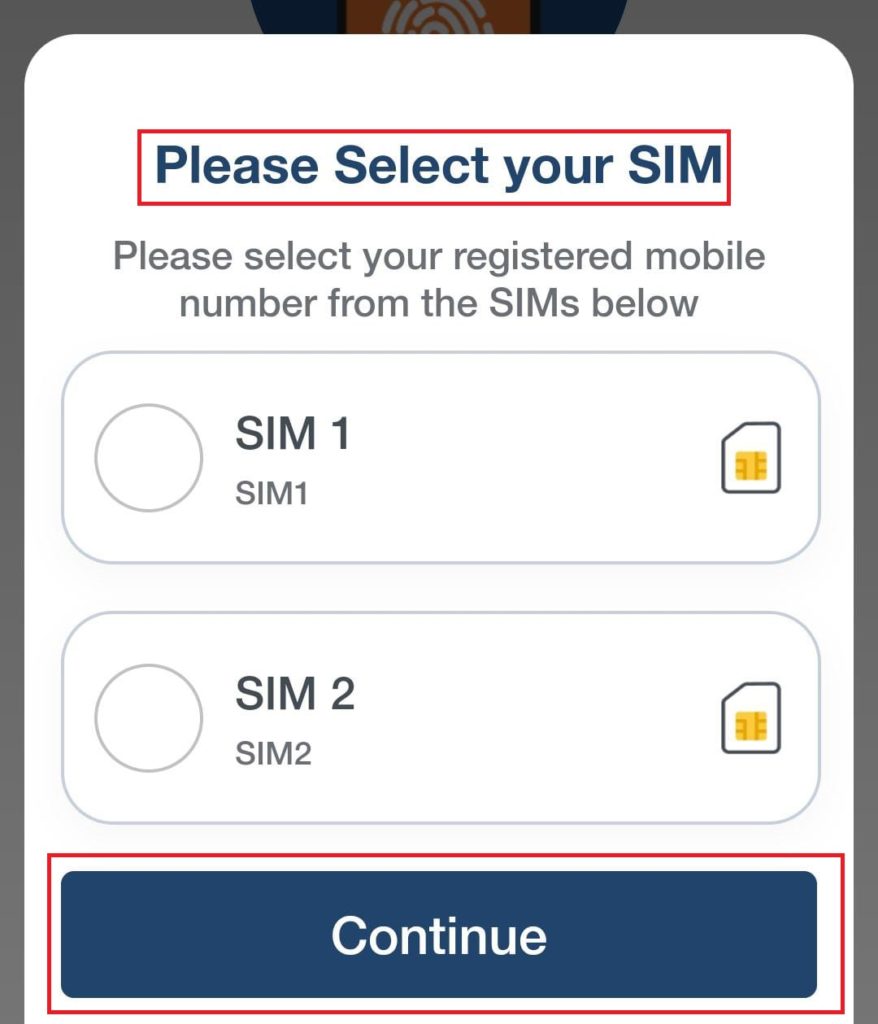

- After Clicking on the Continue button, you have to “Select your Sim” and click on the continue button.

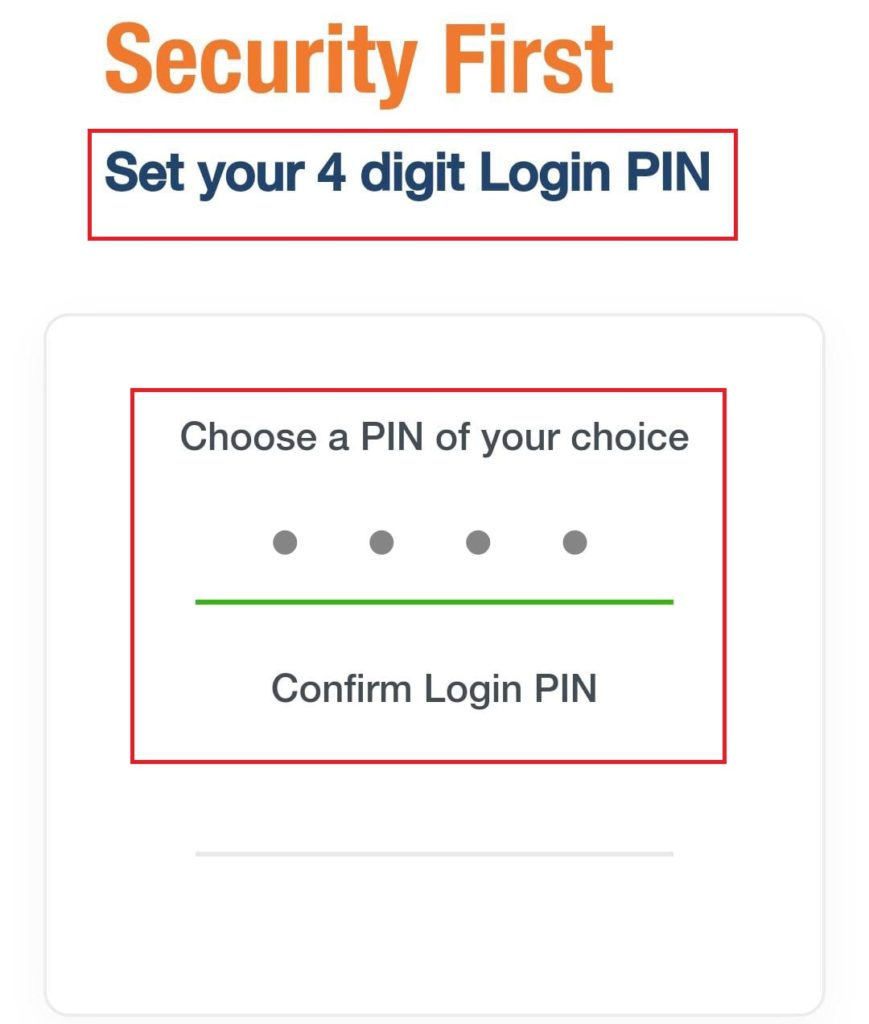

- Next, you need to set your “Four-digit PIN” for the login app. after set the pin, you have an alert related to the login pin set successful.

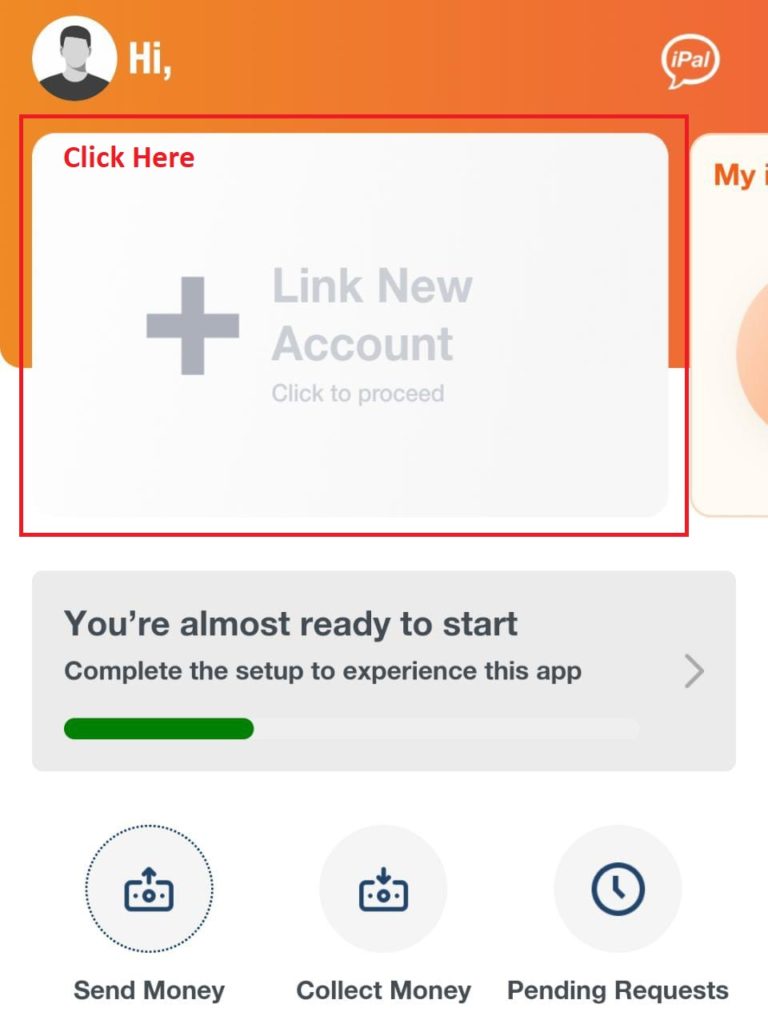

- Now, you have to log in to the app with your Four Digit PIN, find the “Link New Account” Banner, and Click on it.

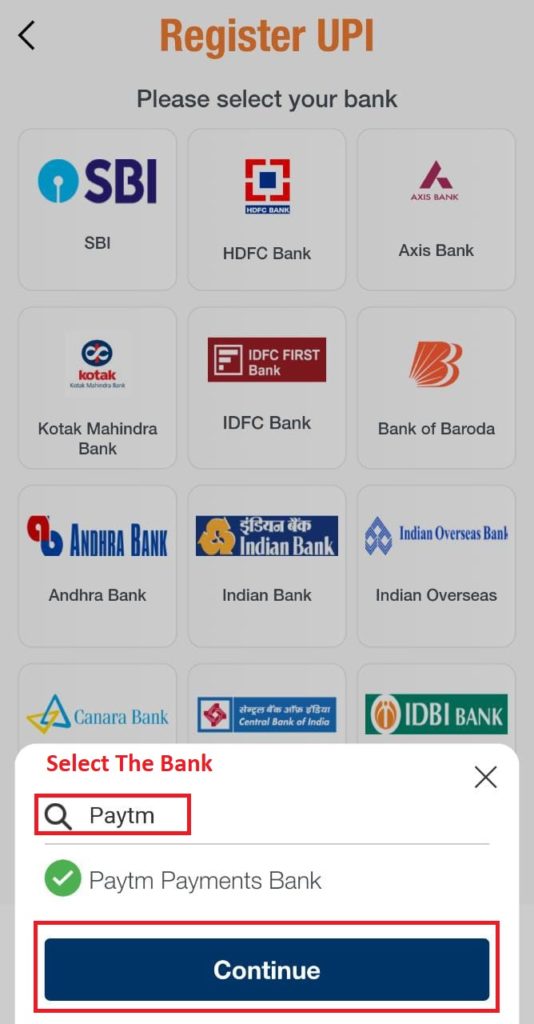

- Next, you have to “Choose Your Bank” and click on the Continue Button.

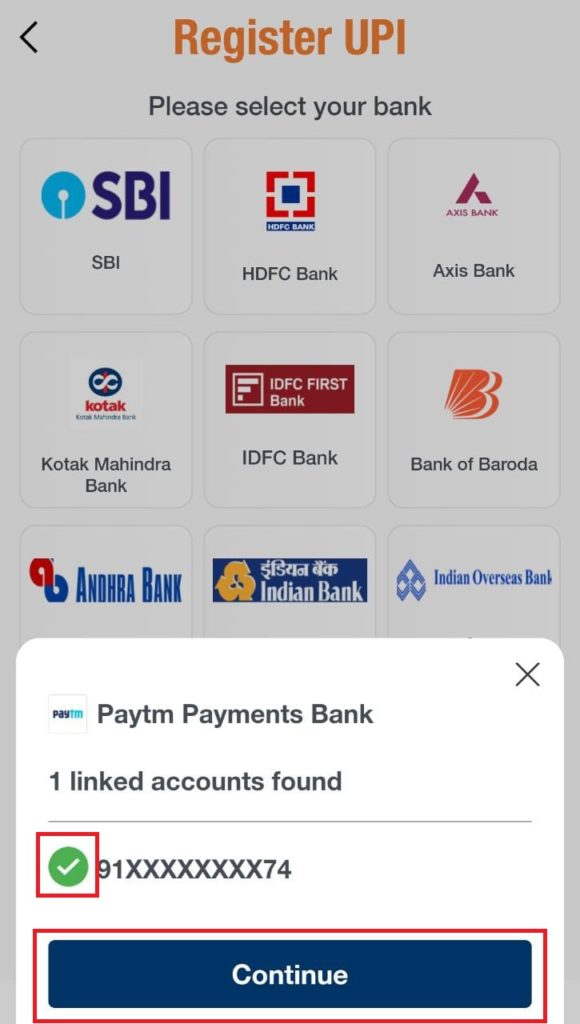

- Now, You have to “Verify the Bank Account” to add your account in the iMobile Pay App, Tick on the Phone number, and click on the Continue Button.

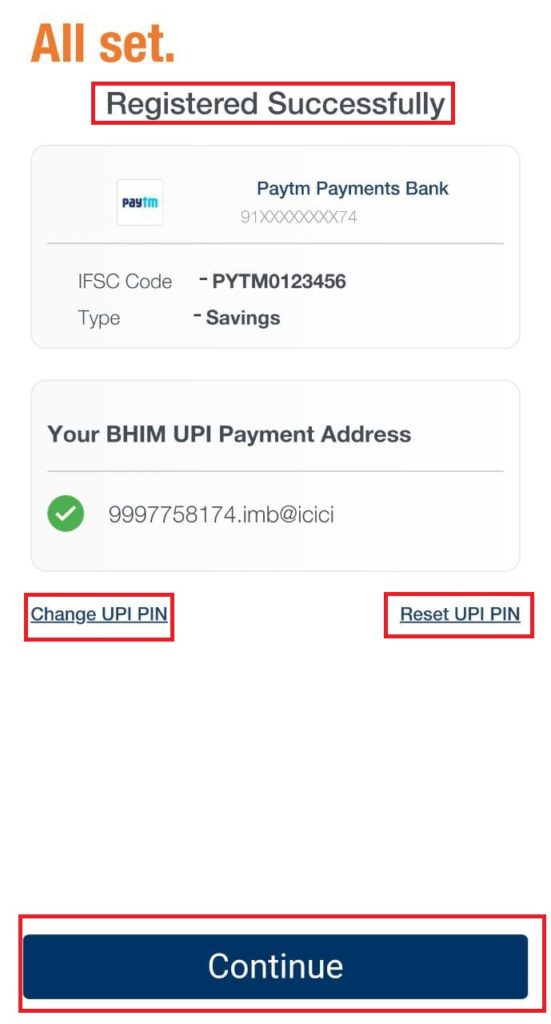

- Now, you got the “Registered Succesfully” Alert. Click on the Continue button at the bottom of the page. Also, you can change or reset UPI PIN in this page.

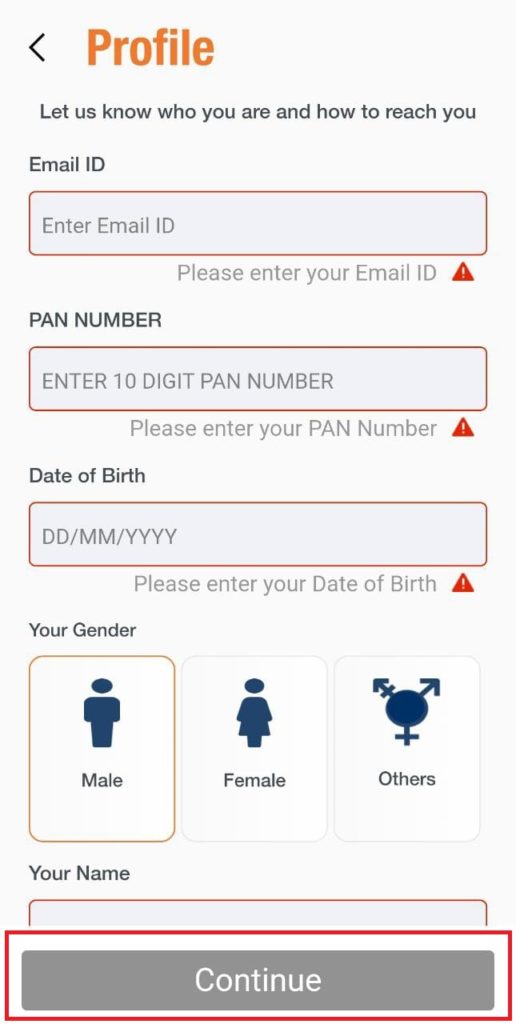

- Now, you have to “Complete the Profile Set Up” to enter your personal details like email id, pan number, date of birth, and gender; then, click on the Continue Button.

- Now, your bank account successfully links with the iMobile Pay App.

Highlighted Features of iMobile Pay App

Here we will share some highlighted feature of iMobile Pay App.

#1. Secure Transactions

Your transactions on your phone will be secured with the ICICI Bank’s proprietary technology and AI-powered android application, iMobile Pay.

Not only can you perform daily banking and online transactions, but you can also send and receive money from friends and family in India.

You just have to connect your bank account with this application, and then you are ready for doing transactions directly from your bank with your android phone.

#2. Manage ICICI Bank Account

You can manage your ICICI Bank account with the iMobile Pay app. With the iMobile Pay app, you will be able to see your FD, account balance, and more. It is easy to register for this app by creating an account with your username, password, and phone number.

If you don’t have an account in ICICI bank, then you can even create it online using this iMobile Pay application by just uploading some documents.

#3. Manage Life Insurance Policies

The ICICI bank mobile banking app iMobile Pay has made it possible for customers to access their life insurance policies with just a few touch-points. You can even take out loans against your policy to meet your short-term financial needs.

The app not only allows you to manage many of your transactions but also provides you with an easy way to understand and update your policy.

#4. Open Demat Account

ICICI bank mobile banking app offers you an account for your investments. You can open a demat account and invest in stocks with the iMobile Pay App. The process is easy and convenient.

ICICI Bank has been working to provide you with the best Financial Services. You can do trading and invest in stocks with this app. However, there are several options of investments, and still, you can do trading and purchase and sell stocks.

#5. Pay Bills & Do Recharge

The ICICI iMobile Pay application is a convenient and secure way to pay bills and do recharges from any location. You can make bill payments from your mobile phone or laptop through the app, as well as recharge your prepaid mobile number. The security of this application meets stringent RBI guidelines for financial transactions.

Benefits of Using iMobile Pay App

- You can open your Bank Account at ICICI Bank online by using this application.

- It offers an option to open a Demat Account with which you can invest your money.

- You can manage your whole ICICI Bank with this single application.

- No matter which Bank Account you are using, you can use this iMobile Pay app to do transactions and receive payments.

- With iMobile Pay by ICICI, you can now pay your bills and recharge your prepaid mobile phone with the touch of a button.

- You can apply for loans, and there are several offers like this in this app.

- There is a Referal System too with which you will get 2000 payback points and 1200 JPmiles whenever your friend successfully signup and do a card setup.

- You can create and manage your current FDs and savings of your Bank account with this single app.

Disadvantages Of Using iMobile Pay App

- There are not several investments options available; however, the trading and sell and buy of stocks options are available.

- The user interface is not up to the mark but is still ok.

- As this application is new, there are some bugs in the app that many users point out. But it can be fixed through updates.

Conclusion

iMobile Pay is a mobile payment app that not only allows ICICI customers but also any bank customers to make digital payments on their smartphones. It eliminates the need for a card and makes transactions faster and more convenient. The app is available on both Android and iOS devices, so you can have access to your account wherever you are.

Well, if you are an ICICI Bank customer, then this app can be more beneficial for you because then you can manage your whole account with this app anywhere.

So, here we have covered all complete details about iMobile Pay and discussed all topics related to iMobile Pay App; if we miss something, then comment, we will solve your query as soon as possible.

If you like this article, then do comment and follow us on social media.

Heartfelt thanks for reading!